Platinum as an Investment

The concept of investing in platinum is a relatively new one. While gold and silver have been trusted stores of value for thousands of years, platinum does not have the same monetary history.

Today, platinum is popular among precious metal investors. Even so, platinum investment makes up less than 10% of annual demand for the rare metal. The bulk of demand comes from autocatalyst use in the automotive industry (40%), jewelry (30%), and industrial (20%), based on 2016 data.

Source: Johnson Matthey

Source: Johnson Matthey

That said, platinum appears to be undervalued currently, which has convinced a lot of investors to jump into the mix. Investors also appreciate that the metal has relatively stable industrial and jewelry demand, which helps to support price levels.

But is platinum a good investment? One thing is clear: platinum can be a volatile asset class.

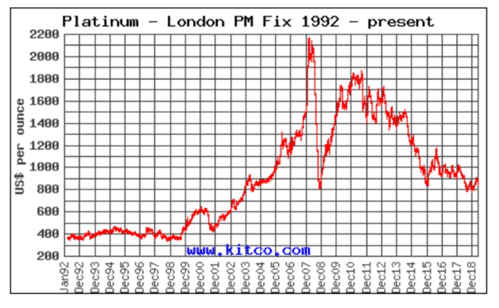

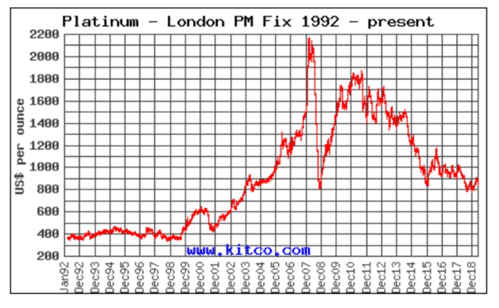

Source: Kitco.com

Platinum’s combination of extreme rarity and strong industrial demand have pushed its price through the roof multiple times. It topped out at nearly $2,200 per oz in 2007, and again hit over $1,800 in 2010, before falling to sub-$1,000 today.

Moving forward, platinum has both positive and negative catalysts from an investment standpoint. On the plus side, jewelry and industrial demand is fairly steady, overall demand typically exceeds supply, known stores of platinum are very small, and the metal is very expensive to mine.

Also, platinum is historically more valuable than gold. Over the long-term it’s traded at an average price of 1.2 times the price of gold. Today, it trades around 0.65 times the price of gold. For some, this is seen as a catalyst for appreciation in the price of platinum; for others, merely a sign that times have changed.

On the other hand, platinum prices face significant headwinds. The main concern is slowing autocatalyst demand, due to the automotive industry’s shift away from diesel and gasoline engines. While electric cars do use platinum, the required amounts are lower than combustion engines (and particularly diesel engines, which are falling out of favor).

This has contributed to a negative investor sentiment, which has further influenced falling platinum prices.

To sum up – Platinum is an exceedingly rare precious metal, with a wide variety of uses in industry and jewelry. It currently seems to be trading quite cheaply, which could make it an attractive precious metal investment opportunity. At the same time, changes in the automotive industry could continue to influence platinum prices in a negative way.

In any case, investing in platinum may be useful in further diversifying your portfolio. And if you already invest in precious metals, you may find platinum’s relatively low price attractive

Source:

Source: