Bellevue 425-454-1283 · Lynnwood 425-672-2646 · Issaquah 425-392-0450 · Tacoma 253-328-4014

It’s just over half-way through 2023, and it’s been an eventful year for global asset markets. This article will look specifically at the precious metals spot market to analyze trends and identify opportunities.

We’ll look specifically at the spot markets for gold and silver, as well as platinum and palladium.

Here are some key takeaways from the first half of 2023.

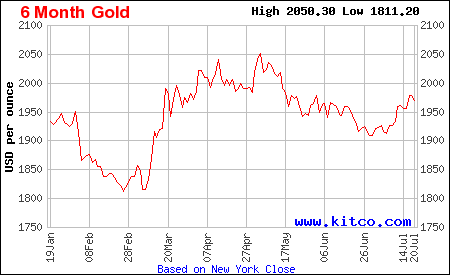

Source: Kitco.com

Gold investors have had a good year. In May 2023, gold reached a high of $2,050.30, just shy of the $2,074.88 all-time high set in summer 2020.

Gold spot prices have benefited from a number of macroeconomic factors, including a rising interest rate, a risk-off investor environment, and strong demand.

Gold is often used as an inflation hedge to help protect portfolios from sustained high inflation. As investors and governments throughout the world grapple with sticky inflation figures, gold spot prices have benefited from increased demand from this segment of the market.

Although gold investors have had a good year, some expected more from gold given the “perfect storm” of macroeconomic factors. It’s likely that gold prices were muted somewhat by stronger than expected stock market performance, particularly in Q2 of 2023. The strong US dollar also didn’t help.

Since flirting with a new ATH in May, gold prices have receded around 4.5%, to $1960.

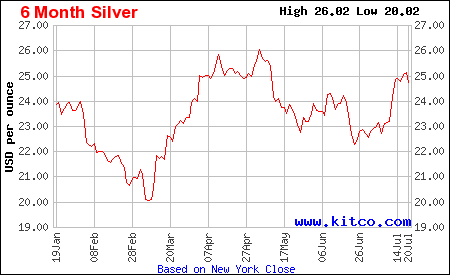

Silver and gold had a very similar trading pattern in the first 6 months of 2023. This is not uncommon, as precious metals prices do often move in tandem. However, some investors like to trade the gold to silver ratio, which takes advantage of periods of time in which price changes break out of this familiar pattern.

While price movements were similar, the main difference is that silver started from a lower base, in comparison to its ATH, than did gold.

Starting the year off at $24/ozt, silver declined almost 20%, to $20/ozt, before spiking up past $26 in early May. It’s since settled to the $25/ozt region.

In contrast to gold, however, silver has a much higher all-time high of $49.51, reached in 2011. Silver today is trading at closer to 50% of its all time high, while gold is around 95% of its ATH.

However, the silver spot price spike in 2011 was very short-lived. Investors flocked into silver – which was relatively scarce at the time – out of concern over monetary inflation and government insolvency. It was a quick, dramatic spike up, followed by a fast decline.

Gold, on the other hand, tends to be a bit more stable. It’s a much larger market – gold has a total market cap of roughly $13 trillion, while silver is around $1.4 trillion. This means that a.) there is much more gold in circulation than silver (in dollar terms) and b.) it takes much more activity in global spot markets to move gold prices, compared to silver.

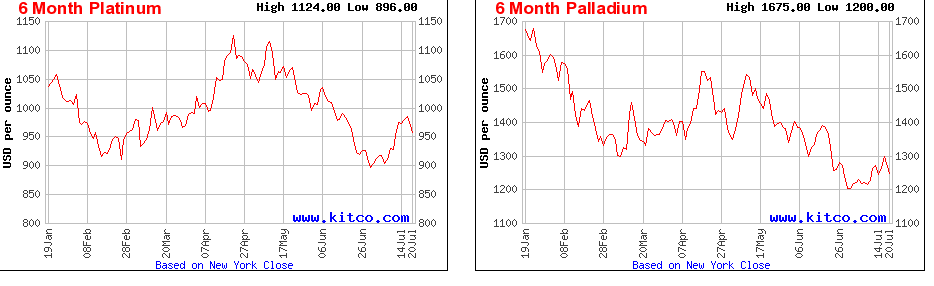

It’s been a less-than-stellar 6 months for platinum investors, and even more disappointing for palladium holders. Platinum has declined around 9.5%, to $960, and palladium is down 25%, to $1260.

What happened?

Both platinum and palladium are highly influenced by industrial demand. Both precious metals are used heavily in industry, and particularly in automotive and electronic manufacturing. A decline in demand in these sectors is hurting both metals, but particularly palladium.

The pandemic, supply chain disruptions, and weak demand in the automotive sector greatly hurt palladium prices in the past few years — and demand still hasn’t recovered to pre-pandemic levels.

Plus, many manufacturers started using platinum instead of palladium, which has historically been cheaper to use.

The result is that palladium prices have been under pressure for several years. Long-term investors may still find a good value proposition in palladium, however, considering prices are around half of what they were a few years ago.

Platinum investors may have more to look forward to. Demand is strong, and supply is forecasted to be running at a deficit in 2023 (meaning production is lower than estimated demand).

In the long run, both platinum and palladium may present interesting opportunities for precious metals investors. If you already own gold and silver, expanding into PT and PD might help improve your portfolio diversification.

It’s been an eventful year in global markets. It’s also been an unpredictable year, with many expert forecasts falling short or missing the mark entirely.

Ongoing factors including the war in Ukraine, global energy prices, stubborn inflation, and tightening monetary policy are all affecting global asset prices.

In times like these, it pays to have a well diversified portfolio.

Are you under-allocated to precious metals? Bellevue Rare Coins offers investment-grade bullion (gold, silver, platinum and palladium) at industry-leading prices. With four convenient Seattle-area locations, we are the premier bullion dealer in the Pacific Northwest.

Stop by our locations today, or place your order over the phone. We also offer live bullion pricing on popular products with transparent, competitive pricing.