Bellevue 425-454-1283 · Lynnwood 425-672-2646 · Issaquah 425-392-0450 · Tacoma 253-328-4014

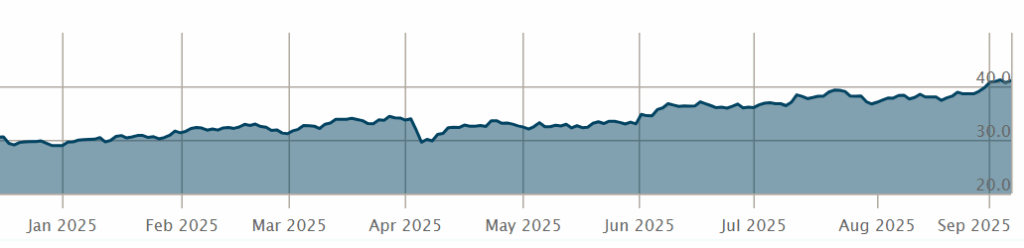

Silver spot prices have been on quite the winning streak in 2025, gaining over 40% year-to-date. Just in the first week of September, silver spot price has surged past $40 – for the first time since 2011.

What’s driving the surge – and what’s next for silver prices?

Silver spot started 2025 at just $29.70 per ounce, and has been on an almost constant tear since then (excluding a brief dip in April, when broad asset prices were cratering). It now stands at over $41 per ounce as of the time of this writing, an increase of more than 40%.

Even in a market where equities are doing very well, 40% growth in just 9 months is impressive. There are likely several factors at play, including:

With the backdrop of silver topping $40 an ounce, what might be in store in the coming months?

While nobody can know for sure, it wouldn’t be surprising to see some consolidation around the $40-$42 mark for a period of time. Often after rapid moves upward, prices will stay range-locked for a period of time. Unless there is a clear short-term catalyst, this scenario is likely (but of course not guaranteed).

In the medium term, silver spot could continue rising or start to fall. A lot may depend on macroeconomic factors, including those referenced above. If the US dollar continues to weaken, this will likely be a continued positive catalyst for silver prices (as the US dollar and precious metals tend to have an inverse relationship).

The last time silver spot topped $40 an ounce was in the spring of 2011, during a very brief but impressive surge in the price of precious metals. The flurry of investment in 2011 was driven by a combination of factors, including economic uncertainty in the wake of the Great Recession, inflationary pressures, doomsday concerns, and a good old fashioned short squeeze in the spot markets.

While we can draw some parallels between 2011 and 2025, the recent run in silver spot prices appears to be more sustainable than the 2011 run.

It’s also worth noting that silver is nowhere near its 2011 highs when you look at the inflation adjusted returns. In 2011, silver briefly spiked to $47+ per ounce. Inflation-adjusted for 2025 dollars, that’s nearly $67.50. In other words, silver has some room to go before revisiting the highs seen in 2011.

Looking to buy or sell silver bullion in the greater Seattle area? Bellevue Rare Coins is the northwest’s trusted bullion dealer with over 40 years of experience serving our local community. Get in touch today, or stop by one of our convenient Seattle area locations (Bellevue, Lynnwood, Issaquah and Tacoma).