Bellevue 425-454-1283 · Lynnwood 425-672-2646 · Issaquah 425-392-0450 · Tacoma 253-328-4014

Investors in palladium have been in for a bumpy ride the last several years.

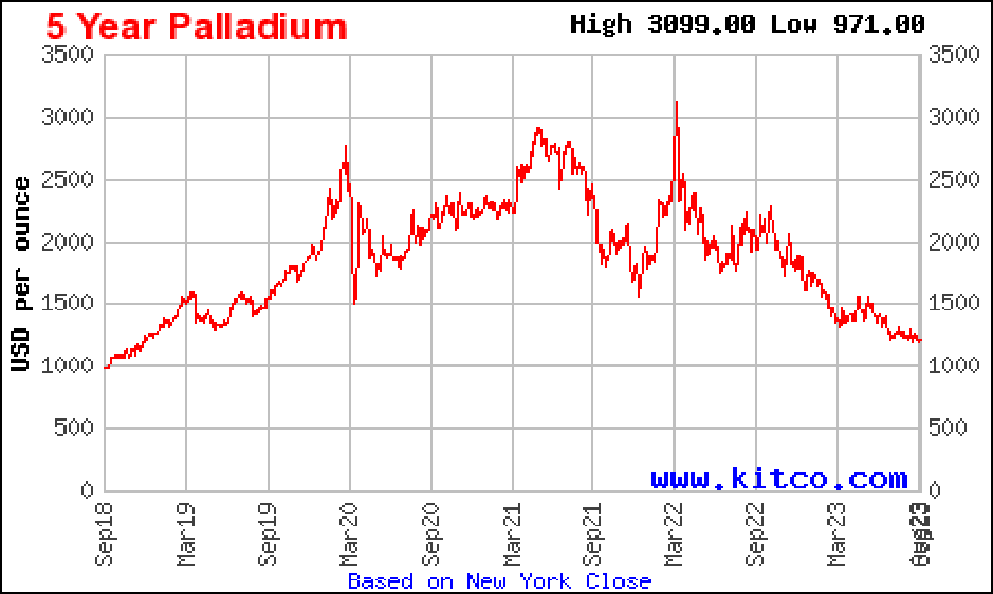

After spiking to an all-time-high of $3,099 per oz in March, 2022, the palladium spot price has since declined to around $1,200. This represents a decline of roughly 61% from the all-time high.

So, what happened to the once much-hyped precious metal? And what can precious metals investors learn from the shift moving forward?

Palladium is a silver-white precious metal that is part of the “platinum metals group”. The other members of this group, which all share similar properties, include platinum, rhodium, ruthenium, iridium and osmium.

Palladium has substantial uses in industry. Most notably, it’s used in the production of catalytic converters, an automotive component in gas-powered vehicles. Around 50% of annual demand for palladium comes from the automotive industry.

Palladium is also favored by investors. It’s available in government-issued coins and bullion products, including:

Like other precious metals, the price of palladium is set on global spot markets, where futures for the metal are traded. Activity on spot markets is influenced by manufacturers, investors, banks, and commodity traders.

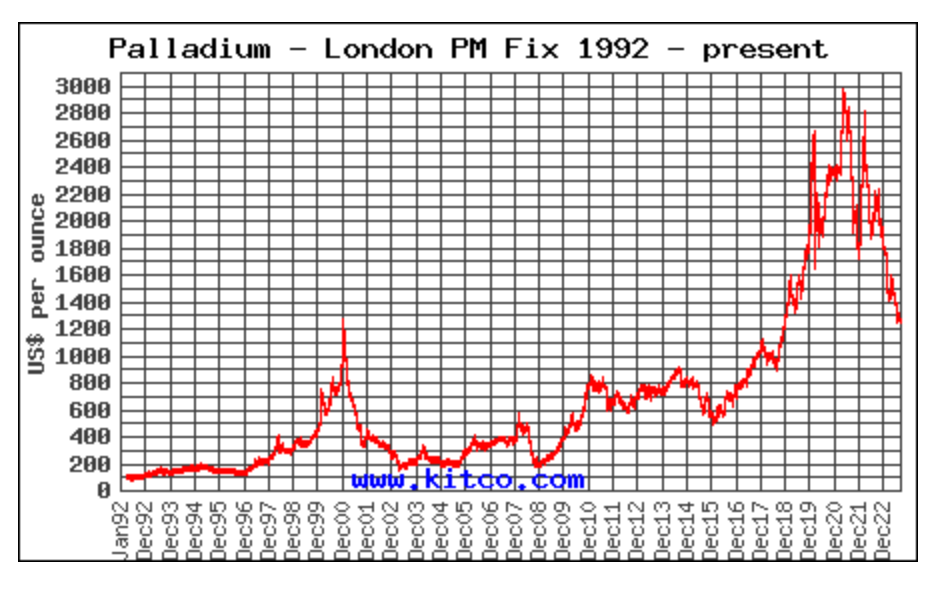

Image source: Kitco

Image source: Kitco

The chart above represents the spot price of palladium from 1992 until 2023.

And below, a chart shows the more recent price movements of palladium from 2018 through 2023.

Palladium has a relatively small total market size, compared to other precious metals like gold and silver. This means that the price tends to be a bit more volatile. It’s also not typically hoarded by central banks, like gold is, which further influences volatility.

Even so, the last 5 years has been particularly volatile for the palladium market. What happened?

One of the primary uses for palladium is in the manufacture of catalytic converters, which are exhaust emission control devices used in most vehicles.

The recent surge in activity in the electric vehicle (EV) industry is shaking up the palladium market, simply because EVs don’t require catalytic converters.

So, for every EV manufactured, that’s one less vehicle that requires palladium. Each catalytic converter uses between 3 and 7 grams of palladium, contributing significantly to global demand for palladium.

Analysts at SP Angel estimate that sales of palladium in 2023 could be lowered by approximately 1.5-2.25 million ounces, solely due to the shift to electric vehicles. Considering that the total market for palladium is only around 10 million ounces per year, this represents a 15-22.5% decline in total demand.

This slip in demand has had clear impacts on the palladium industry. Technically speaking, both platinum and palladium have actually faced deficits in recent months, meaning that total demand is outstripping total supply. However, investors and commodity traders are looking forward to the future EV challenges palladium will face, putting downward pressure on prices.

As is always the case when investing, it’s impossible to predict the future.

There’s no doubt that palladium faces significant headwinds moving forward, due to the increasing adoption of electric vehicles.

Some manufacturers are also swapping out palladium for platinum in catalytic converters, adding to downward pressure.

That said, it’s quite possible that much of this shift is already priced-in to spot prices. The market is quite pessimistic, with both commodity experts and algorithmic traders remaining bearish. Given the significant price declines we’ve already seen, it’s possible that palladium prices are near the floor.

For long-term investing success, it’s best to build a balanced and diversified investment portfolio. That way, you can spread out your bets and avoid being over-concentrated in any one particular asset.

If you’re looking to invest in any precious metals (gold, silver, platinum, or palladium), come to Bellevue Rare Coins first. With industry-leading prices and 4 convenient Seattle-area locations, BRC is the premiere destination for investment-grade precious metals.