Bellevue 425-454-1283 · Lynnwood 425-672-2646 · Issaquah 425-392-0450 · Tacoma 253-328-4014

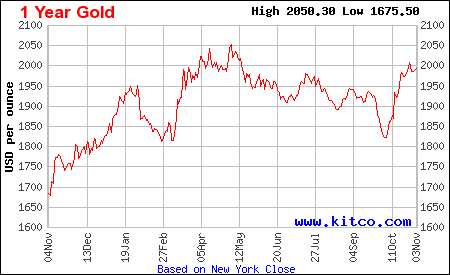

In recent months, gold investors have seen the gold spot price surging and approaching all-time highs. Gold has now spiked over $2,000 per oz multiple times in this year — but what’s driving the gold price rally?

Source: Kitco

In the last 12 months to date, gold has surged from just under $1,700 to right around $2,000 — a gain of over 17% (the year-to-date performance is a little lower, given gold’s late December 2022 rally, as gold started 2023 at $1823 per oz).

This performance compares favorably to broad equity markets. The S&P500, an index of America’s 500 largest public firms, was up 8.3% in the last 12 months to date, while bond investors are experiencing one of the worst market crashes in history.

While long-duration bonds have crashed by as much as 53% over the last few years, gold has actually flirted with all-time-highs. In May 2023, gold broached $2050 per oz, bringing it within 1.2% of the $2074.88 gold all-time-high reached in August 2020. Today, at around $1990 per oz, gold is still within 4.3% of the all time high.

Like other markets, gold spot has had a bumpy ride this year, with a significant dip as recently as October. But gold has come roaring back in recent months. What’s behind the gold price rally?

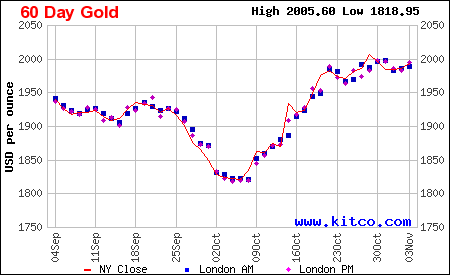

Source: Kitco

In October and November 2023, gold prices have surged dramatically. But why?

As always, many factors influence the price of gold, from monetary policy to global events and stock market sentiment.

But if we look at the timeline, the result is immediately clear: This surge in gold prices has largely been driven by global events, and more specifically, by the Israel-Hamas conflict.

The tragic conflict that has broken out in the middle east has sparked concerns of escalation and widespread war. In the investment world, these concerns often lead to a “flight to safety”, as money moves from riskier assets into so-called “safe haven” assets, such as gold.

We saw a similar pattern play out at the start of the Russia-Ukraine conflict in early 2022. Gold spiked as much as 7.5% in the first 11 days of the conflict, before pulling back into a more stable, multi-month rally.

Gold has a reputation as a “safe haven” asset. This means two things essentially:

Are either of these things true?

First, is gold safe? Well, gold has been valuable for literally thousands of years. It’s never gone bankrupt, never crashed to zero, and never become worthless. The price of gold can certainly go down – but unlike companies, gold can’t “go bankrupt” or crash to zero. This role as a relatively stable store of value has been driving gold demand for thousands of years, and is one of the many reasons that most governments and central banks around the world own gold.

Second, is gold attractive during times of instability? The data shows that it is. We’ve seen time and time again, during periods of uncertainty, conflict, and risk, market forces tend to flock into gold, driving up the spot price. The start of the Israel-Hamas conflict in 2023, the start of the Russia-Ukraine conflict in 2022, and the start of the Covid-19 pandemic in 2020 are three recent examples.

This year, the meltdown in the bond market may also be driving gold demand. Bonds are traditionally seen as another so-called “safe haven” asset. But this year, and really since 2021, bond prices have been anything but safe. Long-duration bond prices have declined by as much as 53% since 2020, due primarily to increasing interest rates.

Gold spot prices have certainly been on the move. What’s next for the end of 2023 and into 2024?

As always: Nobody knows, really! Sorry to be the bearer of bad news, but the prices of any assets are extremely challenging to predict. Gold is no different.

There are both positive drivers and negative headwinds at play for gold.

On the negative side, interest rates are high and will likely stay high. This creates some drag on gold demand, as investors weigh whether it’s worth investing in income-producing assets in this higher interest rate environment.

On the positive side, Diwali is coming up, which typically creates a surge of investor demand. And historically, gold has performed well in the period of mid-December through mid-February. If that trend were to play out again, could we see another all-time-high in gold prices? Only time will tell.

As always, investors should make their own decisions when it comes to buying and selling assets. Given the current macroeconomic outlook, are you buying, selling, or just holding onto your gold?

If you live in the Seattle area, be sure to come to Bellevue Rare Coins for all your gold needs. We sell a wide variety of gold bullion at some of the lowest premiums in the industry (see our live gold pricing here). And when you’re ready to sell, Bellevue Rare Coins makes selling gold easy with some of the highest payouts available anywhere.